Couples, Money, and Conflict

Stress related to money and inflation is at the highest level recorded since 2015, according to APA’s March 2022 Stress in America survey. A top source of stress was the rise in prices of everyday items due to inflation (e.g., gas prices, energy bills, grocery costs, etc.)

Families may have fears about mortgages, college tuition, retirement, and day-to-day expenses. Worries about money may impact many aspects of peoples’ lives, including housing and health care decisions, family planning, relationship conflicts, and more. [1]

Understand How Financial Stress Affects Your Mental Health

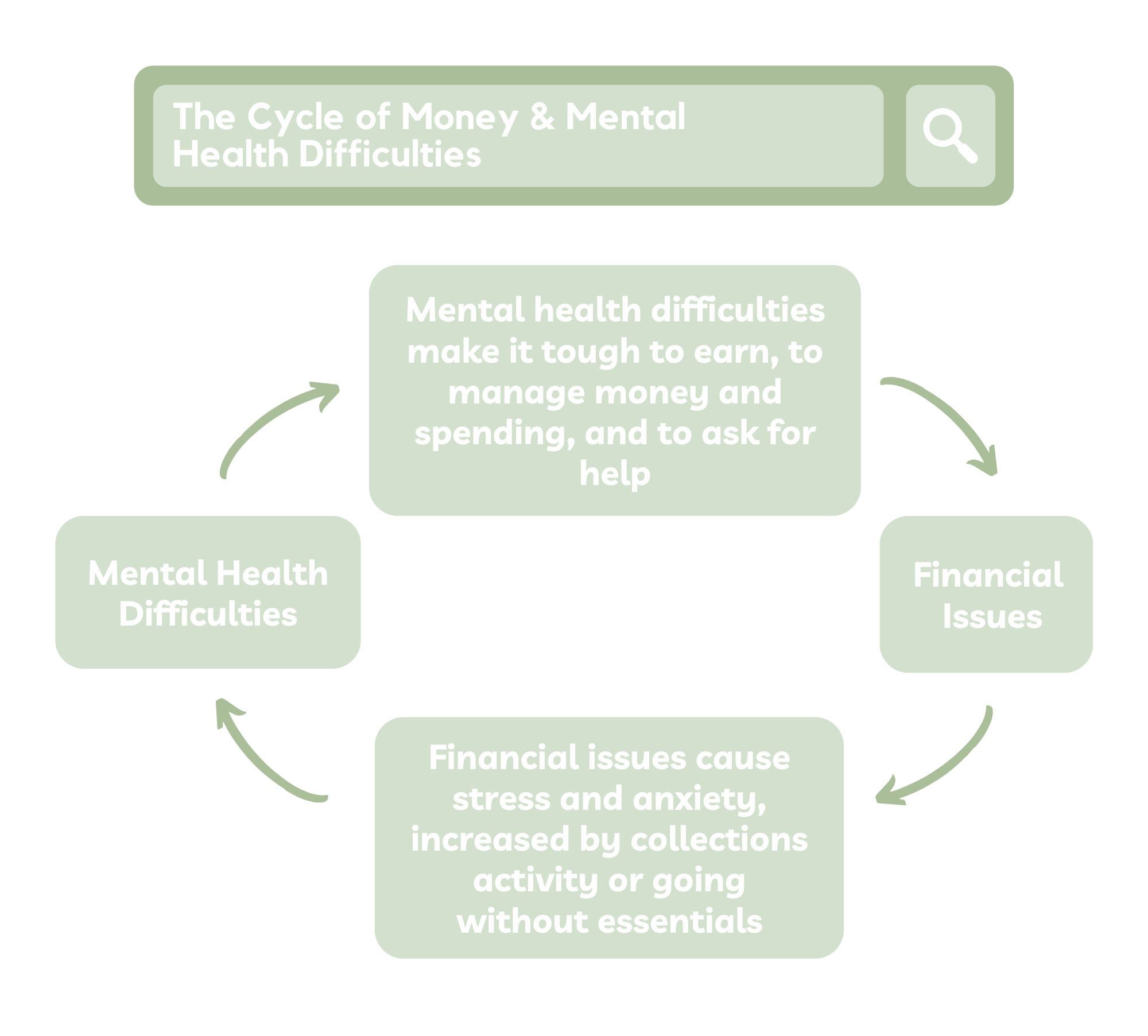

Research has shown that mental health and financial health are linked. Experiencing financial anxiety and uncertainty can be all-consuming and highly stressful. It can contribute to mental health conditions such as depression and anxiety. Financial stress can exacerbate existing mental health conditions and make them harder to manage.

People undergoing financial stress may experience a constant sense of dread, fear, and worry. The stigma and shame around debt makes it difficult to ask for help. People tend to withdraw and then experience feelings of isolation.

The constant tension makes you feel irritable, depressed, and affects your relationships – especially with your spouse. People under this kind of duress have trouble with their sleep patterns and often experience episodes of sleeplessness. Eating patterns may also be disturbed. Fatigue and lack of motivation may also present. Stress over finances is also known to contribute to physical ailments.

Money and Conflict in Your Relationship

One of the main things couples fight over is money. According to a survey conducted by Northwestern Mutual, 41% of people surveyed said financial stress and anxiety had an impact on their relationships with their spouses/partners. 1 in 5 (19%) Americans said they have financial disagreements with their significant other at least monthly.[2]

Conflict about money can stem from (this is not an exhaustive list):

Lack of communication

Unclear financial goals

Mismatched financial priorities

Disagreement on spending limits

Incompatible attitudes towards money

Hiding money

Miserliness

Financial stress or strain

Unshared/individual debt

Joint debt

The covid-19 pandemic

Effective Communication

In order to have a healthy relationship with money as a couple, you need to talk about it. There is this idea held by many that talk of money is tacky and improper. It is a topic that is often avoided by couples because it makes people uncomfortable and often leads to conflict.

Compromise

When it comes to money, some people are less willing to compromise. This is definitely an area where mutual compromise is essential in order to maintain stability.

Budget

To ensure smooth financial management, couples should create a budget together. There should be a spending framework that is mutually agreeable. However, many couples do not operate off a budget, nor do they discuss money management before they get married. This causes disconnect and disagreements when it comes to managing the household and personal expenses.

Financial Goals and Priorities

Often, people are not clear about their individual financial goals. Once you are a part of a couple, your personal financial objectives can be incorporated into your financial goals as a couple. People consider marriage as being part of a team, but often do not apply the same thinking to their finances. Approaching money with a ‘mine and ‘yours’ attitude, rather than with an ‘ours’ just adds to the problem.

Another area that couples need clarity in is financial priorities. For example, you may want to buy a house, but your partner wants to put money away. One person might spend on luxuries or on what the other deems non-essential items. Differing spending habits can cause problems, and may lead to one partner being secretive about what they do with money. In the same way, people may have vastly different ideas about how much to save and when to start saving.

Attitude Toward Money

Another factor that contributes to fights about finances is individual attitudes towards money. Consider these questions:

What is your relationship with money?

Do you think about money and financial planning from a place of lack or of abundance?

Are your financial decisions fear-based?

What do you consider unnecessary expenses?

Each partner needs to clearly express how they view money, wealth, economic strife, and financial planning. Knowing where the other stands will help you understand their behavior regarding money, spending, and saving.

Financial Background

Keep in mind each other’s backgrounds regarding money. If one person has grown up with economic difficulties, they will have a very different outlook on money from someone who has grown up wealthy. People have differing values about money just as they do about other areas of their life. Lack of commonalities in this area can cause problems.

Financial Infidelity

Are you honest about what you earn and how you spend? Are there financial resources that you have not disclosed to your partner? Do you have any debt that your partner does not know about, but that makes them liable? Do you or your partner hide your spending from each other?

Hiding purchases or being dishonest about money is a form of financial infidelity. You cannot have an effective discussion about how to manage your finances when there is a lack of trust. Honesty is crucial when it comes to having conversations about and dealing with monetary issues.

Single Income Households and Income Disparity

Sometimes monetary conflict in a relationship is caused by one partner working and the other being unemployed or a stay-at-home parent. When one partner is the sole salary earner, it can create an imbalance in the relationship. The partner who is not earning may feel trapped, which causes resentment. They may feel like their partner is being miserly. Or, they may feel guilty about spending money that they have not earned.

In some cases, the earning partner may feel entitled to have more say on how the income is spent. They may question their non-earning partner about expenses, or begrudge them their purchases.

Disparity in incomes is another area that may prove troubling for couples. When someone earns less than their partner, it can lead to resentment, disagreements, and issues of control. One person may feel that they do not have an equal say in decisions. The other may feel like they are shouldering too much of the financial burden. This can also create an unequal power dynamic, where one person uses money as leverage.

Debt

Couples that are under financial duress may encounter more conflict and disagreement about how to manage their finances. Getting into debt is very stressful, especially when a couple is not on the same page. Couples whose marriages start off in debt experience more stress and have more disputes over money than those who do not. People may blame each other for their money problems, causing further bitterness and resentment.

Child-related Expenses

For couples with children, there may be increased anxiety about financial security. Children come with a multitude of expenses, which can put pressure on budgets and savings. Couples that are already in debt or struggling may have concerns about the future and frequent money-related conflict.

Financial Abuse

Relationships in which one partner is using money as a means of controlling or oppressing the other have harmful dynamics. Financial abuse is about power and control, and money is the means used by the one who has it. It exists in most situations where there is some form of domestic abuse.

The Pandemic and Financial Stress

The Covid-19 pandemic had an extensive impact on the finances of households across the country.

At least half of households in the four largest U.S. cities—New York City (53%), Los Angeles (56%), Chicago (50%), and Houston (63%)—report serious financial problems including depleted savings, and trouble paying bills or affording medical care.[3]

People lost their jobs or had their working hours reduced, which impacted their earning power. Many families and individuals struggled with the burden of healthcare costs. Some households lost their wage-earners to the virus. People are still trying to recover from the devastating and long-lasting financial effects of the pandemic.

Financial Anxiety and the Holidays

Issues and concerns about money become more pressing leading up to the holidays. There is a lot of pressure to spend and consume. Anxiety about how to budget for and meet holiday expenses can start months in advance. For people who are having financial trouble or disagreement around finances, every aspect of the holiday can be fraught. Travel plans can become problematic, as can having house guests. Being stretched thin financially at this time can be highly stressful.

If you and your partner need support and counseling, Trust Mental Health can help. Our therapists are from diverse backgrounds and speak multiple languages. Relationship therapy and couples therapy can help establish open communication in your relationship. It can also help couples reach an agreement, compromise, and understand each other better. Our therapists are experienced in couples therapy and couples counseling. They use techniques such as the Gottman Method to help you increase relationship satisfaction and navigate difficult conversations.

Contact us today for a free 15 minute consultation. We will match you with a therapist best suited to your specific needs.

REFERENCES:

[1] https://www.apa.org/topics/money

[2] https://news.northwesternmutual.com/planning-and-progress-2018

[3] www.rwjf.org